|

Amarco Pricer

Derivatives pricer framework (indices,

equities)

Using the Amarco architecture concepts and leveraging

our trading room activity (design & implement indices and equities

derivatives pricers), we designed and developed a

working high end multithreaded trader pricing framework, optimized for

derivatives pricing instruments (indices and / or equities). It can use

as user interface any Microsoft facility: WPF, Silverlight, Windows

forms or Excel.

Silverlight version |

WPF version |

Forms version |

Excel version |

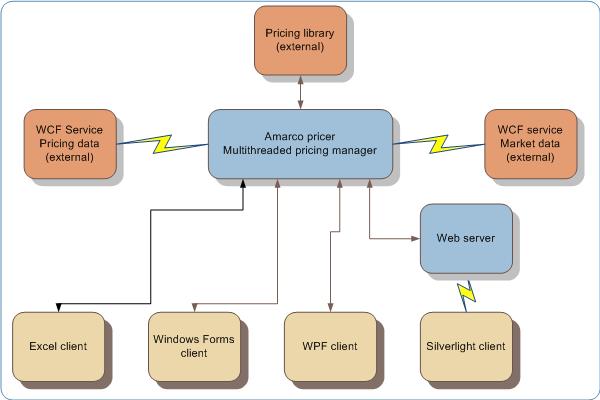

Amarco pricer architecture

This simulates real time data feed through Web

services (WCF), replicates the pricing environment feed from back office

through another WebService, manages limited computing resources for

quants library

-

Multithreaded price calculation for various financial

instruments, simulating limited pricing resources and real time

display of results as they become available

-

Feed pricing data from a WCF web server simulating the back

office, on demand or refresh automatically

-

Real time feed for market bid/ask prices, using an asynchronous

WCF Web service to get market prices (simulation). Asynchronous

results display.

-

Calculate implied volatility for the market data using current

setup of the instruments

-

Multithreaded result display using background workers in the user

interface (Excel, Windows forms, Windows WPF)

-

WCF extension to trace input / output XML exchanges

-

Display user information in system tray to avoid trader manual

action

Various user interface use the same processing core:

-

Windows forms

-

Excel 2007 VSTO

-

Silverlight

-

WPF

Various animated demos are available, please use the

left navigation pane.

Microsoft technology

used: Multithreaded Excel 2007, Multithreaded Windows forms, Dotnet C#

3.5, Visual Studio 2008-2010, WCF service extensions, WCF services

(client, server), VSTO 3.0, Silverlight, WPF.

|